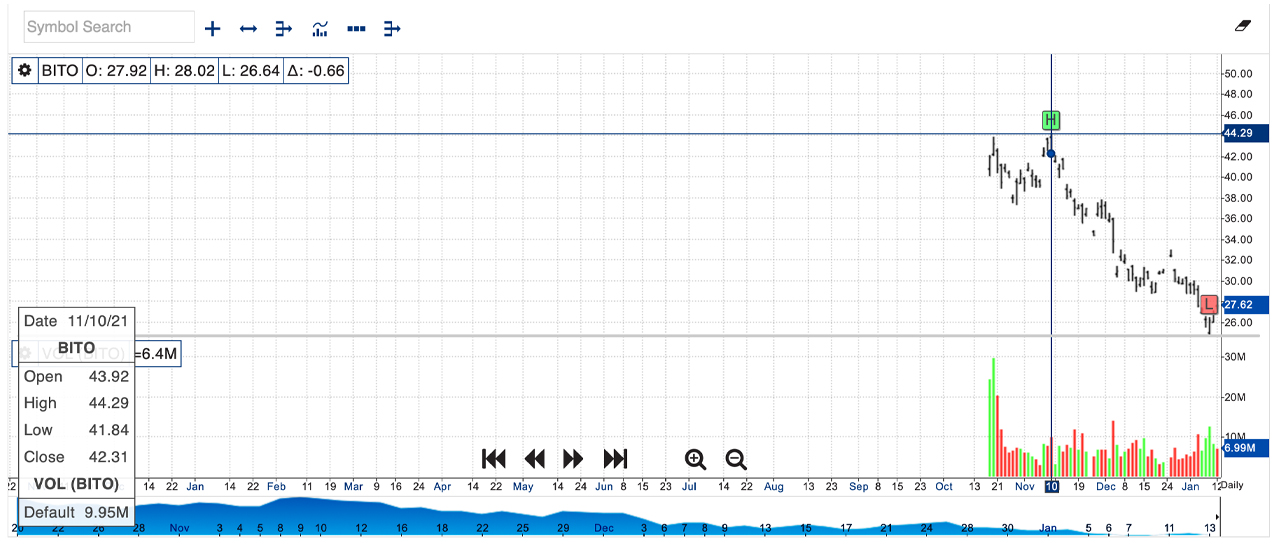

Following the charged-up launching of the Proshares bitcoin exchange-traded fund (ETF), Valkyrie’s bitcoin futures ETF as well as the Vaneck bitcoin technique ETF, interest in these sorts of funds appears to have actually discolored a good deal. After the Proshares bitcoin ETF BITO got to an all-time high up on November 10, the ETF is down 39% over the last 64 days. Valkyrie’s bitcoin ETF has actually likewise lost 37% in value over the last 2 months.

Bitcoin Futures ETF Lull Continues

A huge section of the cryptocurrency area was really hyped up for years regarding the launch of the initial bitcoin exchange-traded fund (ETF), as a variety of bitcoin ETF applications were rejected before 2021.

Finally, when the initial U.S. bitcoin futures ETF was accepted, the launching of Proshare’s bitcoin futures ETF shattered documents, catching near $1 billion in complete quantity throughout the initial 24-hour. Months later on, the Proshares Bitcoin Strategy ETF (BITO) is trading hands for $26.96 on January 13, 2022, yet that rate is 39.12% less than the 44.29 high up on November 10, 2021.

Bloomberg writer Katherine Greifeld discussed in mid-November that the “bitcoin futures ETF frenzy is fading.” “While the Proshares fund absorbed $1.1 billion in just two days — the quickest an ETF has ever done so — that pace of growth has cooled considerably,” Greifeld claimed at the time.

The monetary writer additionally reviewed the Vaneck ETF, as she kept in mind that reduced administration costs might set apart the fund from the remainder. At the moment, Greifeld priced quote Bloomberg Intelligence elderly ETF expert, Eric Balchunas, that claimed:

There’s absolutely a time-out taking place now about the launch mania therefore Vaneck has their job suitable them in attempting to obtain individuals thrilled once again.

Valkyrie’s BTF Down 37%, Vaneck’s XBTF Is Down 27%, Aggregate Bitcoin Futures Open Interest Across Cryptocurrency Exchanges Slid by More Than 38%

The very same can be claimed for the Valkyrie Bitcoin Strategy ETF (BTF) when it got to an all-time high (ATH) of $26.67 per share on November 9, 2021, as well as today it’s altering hands for $16.70 each or 37.38% below the ATH.

The Vaneck Bitcoin Strategy ETF (XBTF) is just down 27.70%, as the ETF traded hands for $58.08 each on November 19, 2021, as well as today it’s trading for 41.99 each. While Proshares as well as the Valkyrie ETFs debuted well prior to Vaneck’s offering, every one of the funds have a solid partnership with area rate of bitcoin as well as the crypto property’s futures markets.

(*2*)

Futures markets have actually seen a decrease in open interest, as complete bitcoin futures open interest throughout cryptocurrency exchanges has actually decreased given that mid-November as well. The greatest variety of bitcoin futures open interest got on November 11, 2021, with over $28 billion.

Today, the accumulation open interest throughout one of the most preferred by-products exchanges is $17.22 billion. That relates to a loss of 38.50% over the last 2 months as well as the pattern is fairly comparable to bitcoin’s (BTC) area market value activity.

What do you consider the 3 bitcoin futures ETFs as well as their general efficiency throughout the last couple of months? Let us understand what you consider this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Google, NYSE, Nasdaq,

Disclaimer: This write-up is for informative objectives just. It is not a straight deal or solicitation of a deal to get or offer, or a referral or recommendation of any type of items, solutions, or business. Bitcoin.com does not offer financial investment, tax obligation, lawful, or bookkeeping suggestions. Neither the business neither the writer is accountable, straight or indirectly, for any type of damages or loss triggered or affirmed to be triggered by or in link with making use of or dependence on any type of web content, products or solutions pointed out in this write-up.