Key Takeaways

Ethereum appears to be like weak across the present value ranges as buying and selling volumes decreases.

Although Ethereum is predicted to finish “the Merge” to Proof-of-Stake this yr, market sentiment is at a low.

A spike in downward stress may see ETH fall so far as $900.

Share this text

Ethereum appears to be like poised for vital losses after failing to beat a essential hurdle in its development. Despite the market’s anticipation for “the Merge,” promoting stress may resume if it breaks the $1,700 assist stage.

Ethereum Resumes Downtrend

Ethereum is weakening whereas buying and selling volumes are falling within the cryptocurrency market.

The second-largest cryptocurrency by market cap appears to be like primed to renew its downtrend after struggling a rejection at the $2,150 resistance stage. Although Ethereum efficiently held $1,700 as assist, it has not proven sufficient power to make a vital development. The present market situations may encourage traders to exit their positions in expectation of decrease lows.

Ethereum is predicted to finish its long-awaited “Merge” to Proof-of-Stake this yr, which may act as a bullish catalyst, however the launch date is probably going months away. Ethereum not too long ago accomplished its Merge testnets and can subsequent give the replace a trial run on the Ropsten testnet. With no last launch date in sight and sentiment within the crypto market nonetheless at a low, Ethereum may face a main correction within the quick time period.

When contemplating that the governing technical sample behind Ethereum is a symmetrical triangle, the latest rejection may very well be adopted by a spike in promoting stress. This technical formation forecasts that after the $2,500 assist stage was breached on May 9, Ethereum entered a 64% downtrend.

A every day candlestick shut beneath $1,700 may additional validate the pessimistic outlook and lead to a steep correction to $900.

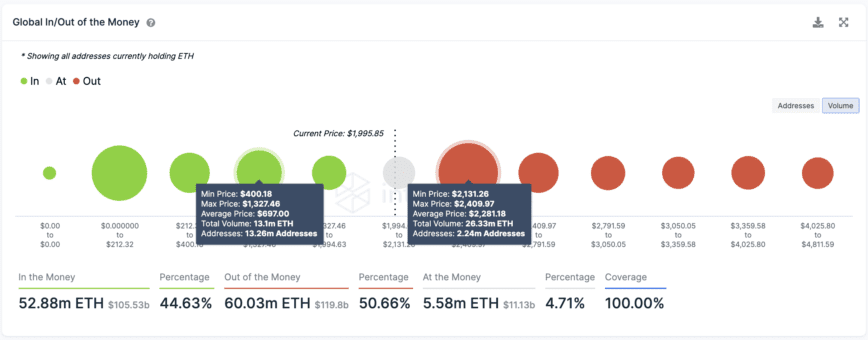

IntoTheBlock’s Global In/Out of the Money mannequin provides credence to the bearish thesis. It exhibits that greater than 2.24 million addresses are “underwater” on their holdings after buying over 26.33 million Ethereum between $2,130 and $2,400. These addresses may promote their belongings within the occasion of one other downswing to keep away from incurring additional losses, including to the downward stress.

In this eventuality, transaction historical past reveals that essentially the most essential assist stage lies between $400 and $1,330, the place 13.26 million addresses maintain greater than 13.1 million Ethereum.

Given the importance of the availability wall between $2,130 and $2,400, Ethereum will possible have to assert this space as assist for a probability of invalidating the pessimistic outlook.

Disclosure: At the time of writing, the creator of this piece owned BTC and ETH.

For extra key market developments, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this text

The info on or accessed via this web site is obtained from impartial sources we imagine to be correct and dependable, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any info on or accessed via this web site. Decentral Media, Inc. shouldn’t be an funding advisor. We don’t give customized funding recommendation or different monetary recommendation. The info on this web site is topic to alter with out discover. Some or all of the data on this web site might turn out to be outdated, or it might be or turn out to be incomplete or inaccurate. We might, however aren’t obligated to, replace any outdated, incomplete, or inaccurate info.

You ought to by no means make an funding choice on an ICO, IEO, or different funding primarily based on the data on this web site, and you must by no means interpret or in any other case depend on any of the data on this web site as funding recommendation. We strongly suggest that you simply seek the advice of a licensed funding advisor or different certified monetary skilled if you’re in search of funding recommendation on an ICO, IEO, or different funding. We don’t settle for compensation in any kind for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

See full phrases and situations.