Key Takeaways

Solana and Avalanche have surged by over 15% Monday.

Both Layer 1 tokens are testing important areas of resistance.

Further shopping for strain might ship SOL to $62 and AVAX to $27.

Share this text

Solana and Avalanche have risen by greater than 15% Monday morning. The upward worth motion has pushed each Layer 1 tokens to essential areas of resistance, hinting at a bullish week forward.

Solana and Avalanche Test Resistance

Upward volatility has returned to the cryptocurrency market, and Solana and Avalanche look like benefiting from it.

SOL has seen its worth improve by greater than 15% Monday, leaping from a low of $38.50 to hit a latest excessive of $44.80. Further upward strain might assist propel Solana via resistance and advance increased.

From a technical perspective, Solana seems to have shaped a descending triangle on its 12-hour chart. The latest upswing has pushed SOL nearer to the sample’s hypotenuse, hinting at a possible breakout. Still, the Layer 1 token must breach the 50-hour shifting common at round $47 to validate this optimistic outlook.

If Solana manages to print a 12-hour candlestick shut above the $47 resistance degree, it might surge by greater than 40% towards a goal of $62.

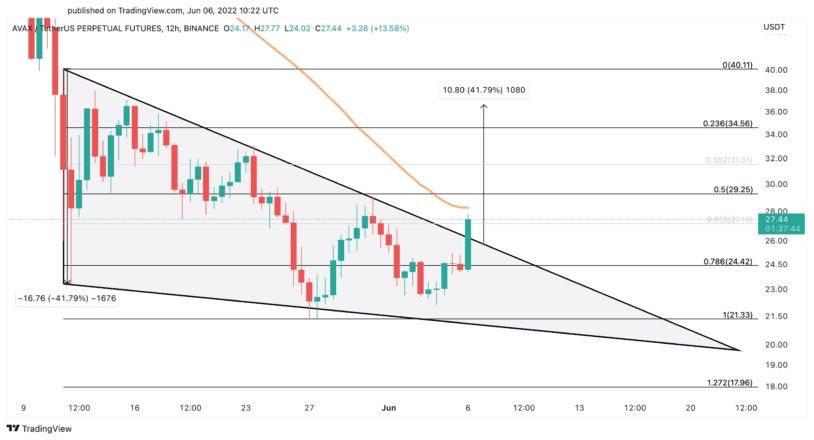

Technical indicators for Avalanche additionally present the potential for short-term development. The Layer 1 token has risen by almost 15% since Monday’s open, overcoming a earlier space of resistance. However, AVAX is but to breach its subsequent provide barrier and put up additional positive factors.

Over the previous few hours, the rising worth motion has allowed Avalanche to slice via the higher boundary of a falling wedge that developed on its 12-hour chart. This technical sample now anticipates that AVAX can advance one other 40% towards $37. whether or not Avalanche can push previous the 50-hour shifting common at $28 will probably verify or invalidate this optimistic outlook.

Although the percentages seem to favor the bulls, warning is suggested across the present worth ranges. Failing to beat resistance might generate uncertainty amongst market contributors, resulting in a rise in promote orders.

If this bearish state of affairs had been to happen, Solana might doubtlessly drop beneath $36 to invalidate the bullish thesis and dip right down to $30. An identical motion might additionally have an effect on Avalanche if it breaks its $21 assist degree, indicating an extra decline to $18 is feasible.

Disclosure: At the time of writing, the writer of this piece owned BTC and ETH.

For extra key market traits, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this text

The data on or accessed via this web site is obtained from impartial sources we imagine to be correct and dependable, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed via this web site. Decentral Media, Inc. just isn’t an funding advisor. We don’t give personalised funding recommendation or different monetary recommendation. The data on this web site is topic to vary with out discover. Some or all of the data on this web site might grow to be outdated, or it might be or grow to be incomplete or inaccurate. We might, however usually are not obligated to, replace any outdated, incomplete, or inaccurate data.

You ought to by no means make an funding resolution on an ICO, IEO, or different funding primarily based on the data on this web site, and it’s best to by no means interpret or in any other case rely on any of the data on this web site as funding recommendation. We strongly suggest that you simply seek the advice of a licensed funding advisor or different certified monetary skilled in case you are looking for funding recommendation on an ICO, IEO, or different funding. We don’t settle for compensation in any type for analyzing or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

See full phrases and circumstances.