Singapore, Singapore, thirteenth August, 2022, Chainwire

TUSD has been endorsed by CryptoQuant, an information evaluation agency for cryptocurrencies, rating within the high eight within the stablecoin efficacy report revealed July 21.

The efficacy report supplied an in-depth evaluation of eight vital stablecoins available in the market (USDT, USDC, BUSD, DAI, FRAX, TUSD, USDP, and GUSD) from 4 dimensions: peg robustness, worth premium, velocity, and accessibility.

In phrases of peg robustness, TUSD ranks among the many high stablecoins. This dimension reveals how dependable a stablecoin is throughout a rise in provide, which happens when customers are redeeming their stablecoins. This is named a redemption run or higher referred to as a “bank-run.”

Robustness is essential for monetary merchandise because it represents stability. Stablecoins with excessive peg robustness permit customers to redeem their property securely, with out concern of a worth shock.

Measuring a stablecoin’s peg requires two metrics: worth deviation and redeemed provide stream. Stablecoins with lower cost deviation and better redeemed provide, have a better likelihood of sustaining their stability. Results present that TUSD has one of many lowest ranges of worth deviation, marking greater peg robustness scores.

TUSD’s excessive robustness rating is well-deserved. Available sources reveal that it is likely one of the most clear stablecoins, totally collateralized by U.S. {dollars} and attested stay on-chain. Also, TUSD is audited in real-time by Armanino, a number one U.S.-based accounting agency, to make sure a 100% collateral ratio.

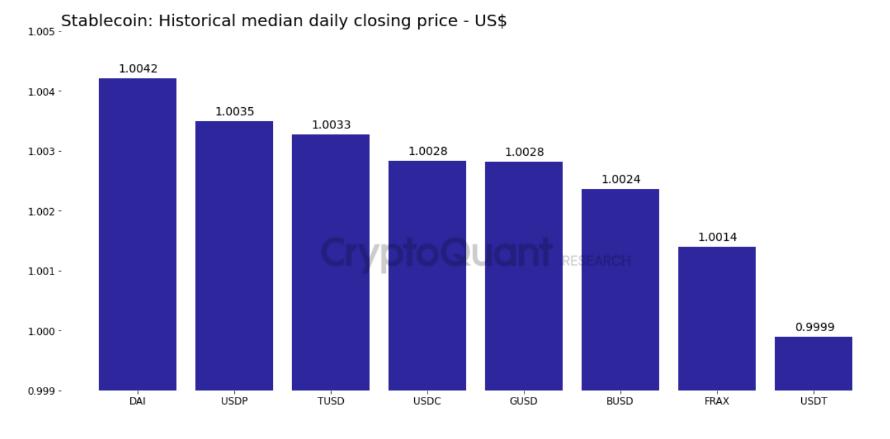

(Different stablecoins’ peg robustness scores)

The worth premium is used to research the historic costs of stablecoins to establish if a token has traded at a premium or a reduction. The report signifies that TUSD ranks someplace within the center. A worth premium permits stablecoin holders to revenue from promoting at a premium within the brief time period, versus losses from buying and selling at a reduction.

Velocity and accessibility are the opposite two dimensions examined within the report. TUSD scores low in velocity and medium in accessibility. Moreover, the report additionally factors out that stablecoins’ availability on public chains is equally necessary to their accessibility on exchanges. While many stablecoins function on Ethereum, TUSD is likely one of the main stablecoins on TRON, whereas BUSD runs on BNB Chain.

(TUSD’s scores within the 4 dimensions)

TUSD rating within the high eight for stablecoins, as proven within the TUSD weblog article and CryptoQuant efficacy report talked about earlier, reveals its all-around effectiveness within the 4 dimensions. The report expects TUSD to see additional progress within the coming months.

About TUSD

TrueUSD is the primary digital asset with stay on-chain attestations by impartial third-party establishments and is backed 1:1 with the U.S. greenback. So far, it has been listed on greater than 100 buying and selling platforms equivalent to Binance and Huobi, and is stay on 11 mainstream public chains together with Ethereum, TRON, Avalanche, BSC, Fantom, and Polygon. TrueUSD is attested to in real-time by Armanino, one of many largest U.S.-based accounting companies, to make sure the 1:1 ratio of its USD reserve to the circulating token provide and the 100% collateral price. Users can entry the publicly out there audit outcomes through the official web site tusd.io at any time.

Contacts

Annabel Gan, [email protected]